Julius Mansa is a CFO consultant, finance and accounting professor, investor, and united state Division of State Fulbright research study awardee in the field of financial modern technology. He educates service students on topics in audit and also corporate money.

- To promptly calculate the equivalent percentage of boost or decrease, move the decimal factor two rooms to the left.

- Many individuals still take the deal though due to the fact that we tend to discount the future & over-value a round figure in today.

- When you contrast home mortgage prices and terms, you will ultimately run into basis factors.

- Maybe 8% (7.5% + 0.5%) or it could be 7.875% (7.5% + 0.375%, which is 5% of 7.5%).

- Basis factors are also usual in discussions concerning borrowing along with investing.

- Each basis factor deserves 0.01 percent of a solitary portion point.

One basis factor is.01%, or one one-hundredth of a percent of yield. Abond's yield that raised from 8.00% to 8.50% would be claimed to have actually climbed 50 basis factors. This mortgage factors calculator gives customized details based upon the info you offer. But, it also makes some presumptions concerning mortgage insurance coverage as well as various other costs, which can be significant.

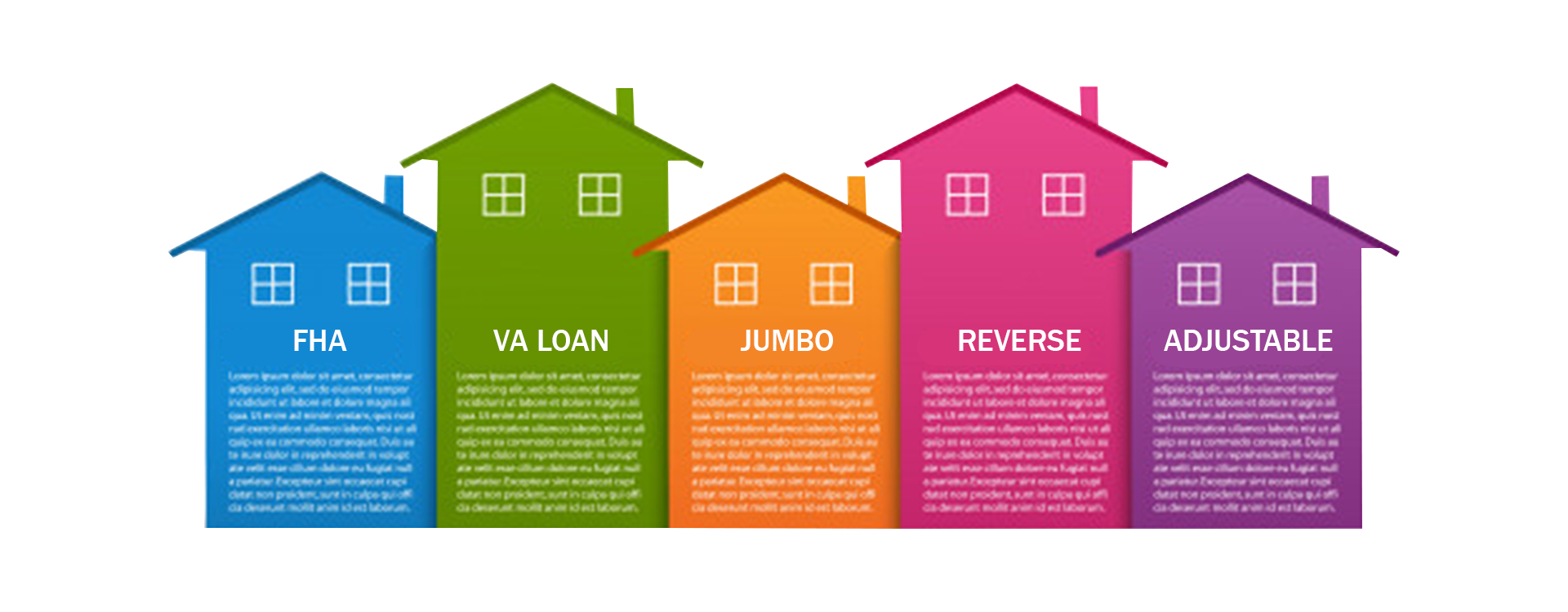

Getting A Home

Usually, investors intend to see returns rising, as well as you'll commonly listen to the changes shared in basis factors. Basis points are frequently utilized to reveal adjustments in the yields on company or government bonds dealt by capitalists. Yields rise and fall, partly since ofprevailing interest rates, which are established by the Federal Get's Competitive market Committee.

How To Pay More On Your Home Mortgage

We additionally reference original research study from other Additional reading respectable publishers where appropriate. You can learn more regarding the standards we adhere to in creating accurate, impartial content in oureditorial plan. Though lots of people wish to see their house increase in worth, few individuals purchase their residence strictly as a financial investment. From a financial investment perspective, if your residence triples in worth, you may be unlikely to market it for the straightforward reason that you then would require to find somewhere else to live.

This may show a rise in home mortgage interest rates by one-eighth to one-quarter by Tuesday or Wednesday. Especially important to large-volume home loan lenders, basis factors-- even simply a couple of-- can indicate the distinction between revenue and loss. Economically speaking, mortgage basis points are more crucial to lenders than to borrowers. Nevertheless, this influence on lenders can likewise impact your home mortgage interest rate. PER MILLE INDICATION A basis factor (often abbreviated as bp, frequently pronounced as "bip" or "beep") is one hundredth of a percent or equivalently one percent of one percent or one ten thousandth.

Exactly How Do Unfavorable Factors Service A Home Loan?

Repaying the residence earlier suggests making more money from the unfavorable points. When a loan provider markets you negative points they are wagering you will certainly not settle your mortgage quickly. The huge problem with financing factors is you raise the finance's equilibrium instantly. This subsequently substantially raises the number of months it takes to break even. If any of the above are not real, after that factors are likely a poor acquisition.

Each lender is special in regards to just how much of a discount the factors get, however typically the following are relatively usual across the sector. If a debtor acquires 2 factors on a $200,000 home mortgage then the price of factors will be 2% of $200,000, or $4,000. Regarding ahead of time MIP, I believe there is an 84-month formula to subtract the price thinking you qualify/itemize. As well as keep in mind that factors can be paid out-of-pocket or valued right into the interest rate of the car loan. Normally, it coincides quantity of help a much larger payday if they can obtain their hands on the extremely big loans out there. Above is a helpful little chart I made that shows the price of home mortgage points for various loans quantities, varying from $100,000 to $1 million.

Bank of America and/or its affiliates, as well as Khan Academy, presume no responsibility for any loss or damages arising from one's reliance on the material supplied. Please additionally note that such material is not upgraded routinely and that some of the details may not for that reason be current. Talk to your own monetary specialist and also tax consultant when making decisions concerning your economic circumstance.

To rapidly determine the comparable percentage of increase or reduction, relocate the decimal point two rooms to the left. For example, if the price of a commercial mortgage loan has actually climbed 25 basis points, it has climbed 0.25 portion factors. Home loan points, additionally called price cut factors, are a type of pre paid passion You can pick to pay a portion of the rate of interest in advance to reduce your interest rate as well as monthly payment. A mortgage point is equal to 1 https://www.businesswire.com/news/home/20190806005798/en/Wesley-Financial-Group-6-Million-Timeshare-Debt percent of your overall financing quantity. Discover more regarding what home mortgage points are and also determine whether "acquiring points" is a great choice for you.