Table of ContentsWhat Is The Current Interest Rate For Mortgages? Can Be Fun For AnyoneWhat Is The Interest Rate On Reverse Mortgages Fundamentals ExplainedAll About What Fico Scores Are Used For Mortgages

The home mortgage, itself, is a lien (a legal claim) on the home or residential or commercial property that protects the promise to pay the debt. This is what makes mortgages a safe type of financial obligation. Because the loan is secured, efficiently utilizing the home as collateral, this implies that if you fall behind in your payments or stop working to pay the loan back, the lender can reclaim the home through foreclosure.

The principal is the initial quantity obtained from the lending institution - what is the current interest rate for commercial mortgages?. When you secure a home loan, the loan provider will designate an interest rate based upon the kind of mortgage you select and your credit report. This rate determines how fast interest builds on your mortgage. The loan-to-value ratio is the quantity of cash you borrow compared with the cost or appraised value of the house you are purchasing.

For example, with a 95% LTV loan on a home priced at $50,000, you might borrow as much as $47,500 (95% of $50,000), so you would need to supply $2,500 as a deposit. The LTV ratio reflects the amount of equity debtors have in their houses. The greater the LTV ratio, the less cash homebuyers are needed to pay of their own funds.

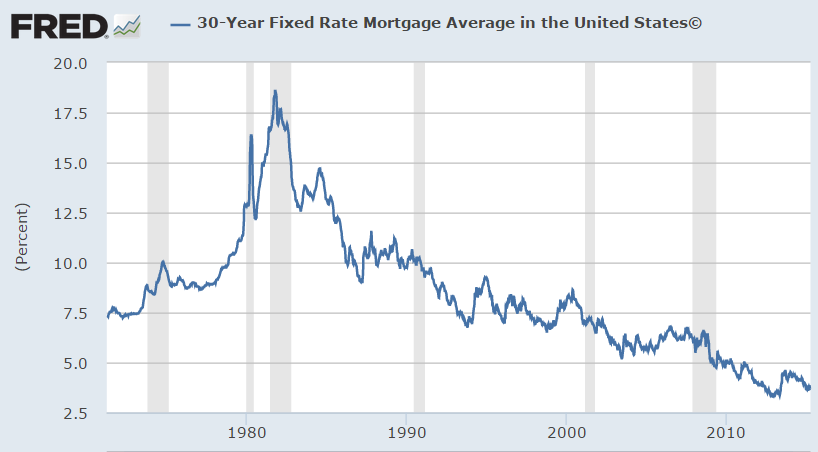

The biggest difference in home loan financing has to do with the interest used to the loan. Given that you'll pay hundreds of thousands of dollars in interest over the timeshare out life of even an average home mortgage, it's necessary to get the rates of interest that's right for your financial situation. The best interest rate can assist you conserve cash over the life of the loan and prevent monetary distress.

Your housing costs are untouched by market conditions. Adjustable Rate Mortgages (ARMs) Rate of interest changes on a regular schedule (normally every 1, 7, or ten years) 30 yearsYou can qualify with lower credit. When rates of interest are low, you will pay less cash. However, if interest rates increase, you will be required to pay more cash.

Balloon MortgageLow rates of interest over an initial period5 years, 7 years, or 10 yearsYou have low payments (sometimes, interest only) for a set period, then the complete balance is due or the loan needs to be re-financed. Most of the times a fixed rate mortgage is typically the much better alternative, because you understand exactly what you will require to pay each month, there will not be any surprises down the roadway, and you aren't at the mercy of market conditions.

If the rate is high when your interest rate adjusts, your payments will increase. An ARM might make sense if you are confident that your income will increase progressively over the years or if you prepare for a relocation in the near future and aren't concerned about potential increases in rate of interest.

An Unbiased View of What Are The Different Types Of Mortgages

The "term" of your home loan determines how quick you settle the loan with interest included. So, if you have a 30-year set rate mortgage, it will take 30 years to pay off your loan. If you have a 15-year loan, you will own your house in half the time it handles the 30-year home mortgage.

If you have a 30-year set rate home mortgage, for the first 23 years of the loan, more interest will be settled than principal; this suggests larger tax reductions for those 23 years. In addition, home mortgage payments will take up a lower portion of your earnings for many years, because as inflation increases your expenses of living, your home loan payments stay continuous.

In addition, equity is built much faster because early payments settle more of the principal. There are mortgage options now available that just require a deposit of 5% or less of the purchase rate. Nevertheless, the bigger the down payment, the less money you have to borrow and the more equity you'll have.

When thinking about the size of your down payment, consider that you'll likewise need money for closing expenses, moving costs, and any repair work or remodelling expenses. An escrow account is established by your lending institution to reserve a portion of your monthly mortgage payment to cover yearly charges for house owner's insurance coverage, home mortgage insurance coverage (if suitable) and real estate tax.

Escrow accounts are an excellent idea since they ensure money will constantly be readily available for these payments. If you utilize an escrow account to pay home tax or property owner's insurance, make sure you are not penalized for late payments, since it is the lender's obligation to make those payments. Down payments can be a huge obstacle to home ownership.

These programs can help you pay as low as 3% down as a newbie home purchaser. HUD and the FHA have support programs, and so do individual states. Need to look for deposit assistance programs in the area you are seeking to acquire a brand-new house? We advise DownPaymentResource.com.

Speak to a HUD-certified real estate therapist today to set a course so you can become mortgage-ready. Your month-to-month home mortgage payment mostly pays off the principal and interest. However, the majority of lending institutions likewise include regional property tax, house owner's insurance coverage and home mortgage insurance (if suitable). This is why month-to-month home mortgage payments are often referred to as PITI (principal + interest + taxes + insurance). The quantity of your down payment, the size of the home loan, the rates of interest, and the length of the repayment term and payment schedule will all impact the size of your home loan payment.

10 Easy Facts About What Is The Current Interest Rate For Home Mortgages Explained

Rates of interest can vary as you purchase a loan, so ask lenders if they offer a rate "lock-in" that will ensure a particular rate of interest for a certain period of time; this enables you to purchase home loans successfully. Bear in mind that a loan provider needs to divulge the Interest rate (APR) of a loan to you.

It is typically greater than the interest rate due to the fact that it also consists of the expense of points, home loan insurance coverage, and other charges included in the loan. If you have a fixed-rate home mortgage and rate of interest drop substantially, you might wish to think about refinancing. A lot of professionals agree that if you prepare to be in your home for at least 18 months and you can get a rate of 2% less than your existing rate, refinancing is a smart option.

Discount points enable you to lower your rates of interest this is what individuals indicate when they say they paid points off their home mortgage. These points are essentially pre-paid interest, with each point equating to 1% of the total loan quantity. Generally, for each point paid on a 30-year home mortgage, the rate of interest is reduced by 1/8 (or.

So if you have a $200,000 home loan at https://diigo.com/0icmfa 4.5% interest, then you might decrease your interest rate to 4.375% by paying $2,000. When shopping for loans ask lending institutions for an interest rate with 0 points and then see just how much the rate decreases with each point paid. Discount points are clever if you plan to remain in a home for some time considering that they can decrease your month-to-month loan payment.

You can pay off your home loan faster by making extra payments each month or each year beyond your regular monthly payment requirement. This speeds up the procedure of paying off the loan. When you send out money, make sure to show that the excess payment is to be applied to the principal.